The Changing Face of Social Investment

The prevalence and value of business investment for societal impact is growing, whether that be through for-purpose or social enterprise business structures or by organisations investing in their communities, social innovation and social procurement strategies.

Recognition of this change is evident in the rebranding and expansion of the London Benchmarking Group (LBG) framework to the expanded and impact driven Business for Societal Impact (B4SI). Still coordinated by Corporate Citizenship, the B4SI Framework is a measurement and management standard that ‘allows companies to measure, strategically analyse and enhance the impact and business benefits of activities that fall outside of its core business operations’.

While an investment program can take several forms, Strive Philanthropy reported that 2020 was a notable year for corporate philanthropy, citing a value of $1.1 billion from the top 50 givers (up $155 million compared to 2019). The report found this increase was driven by responses to community needs during crises, such as the bushfires and Covid-19, with the increase in the percentage of pre-tax profit given due to both an increase in donations and a decrease in profits.

We wrote previously about social investment pathways and the types of organisations that have embedded programs for co-creating social and environmental value alongside financial return. This article takes a fresh look at deriving value from an impact measurement and monitoring system. For a list of key impact achievers during the past year, see the Impact 25 (Pro Bono Australia initiative) 2021 Winners.

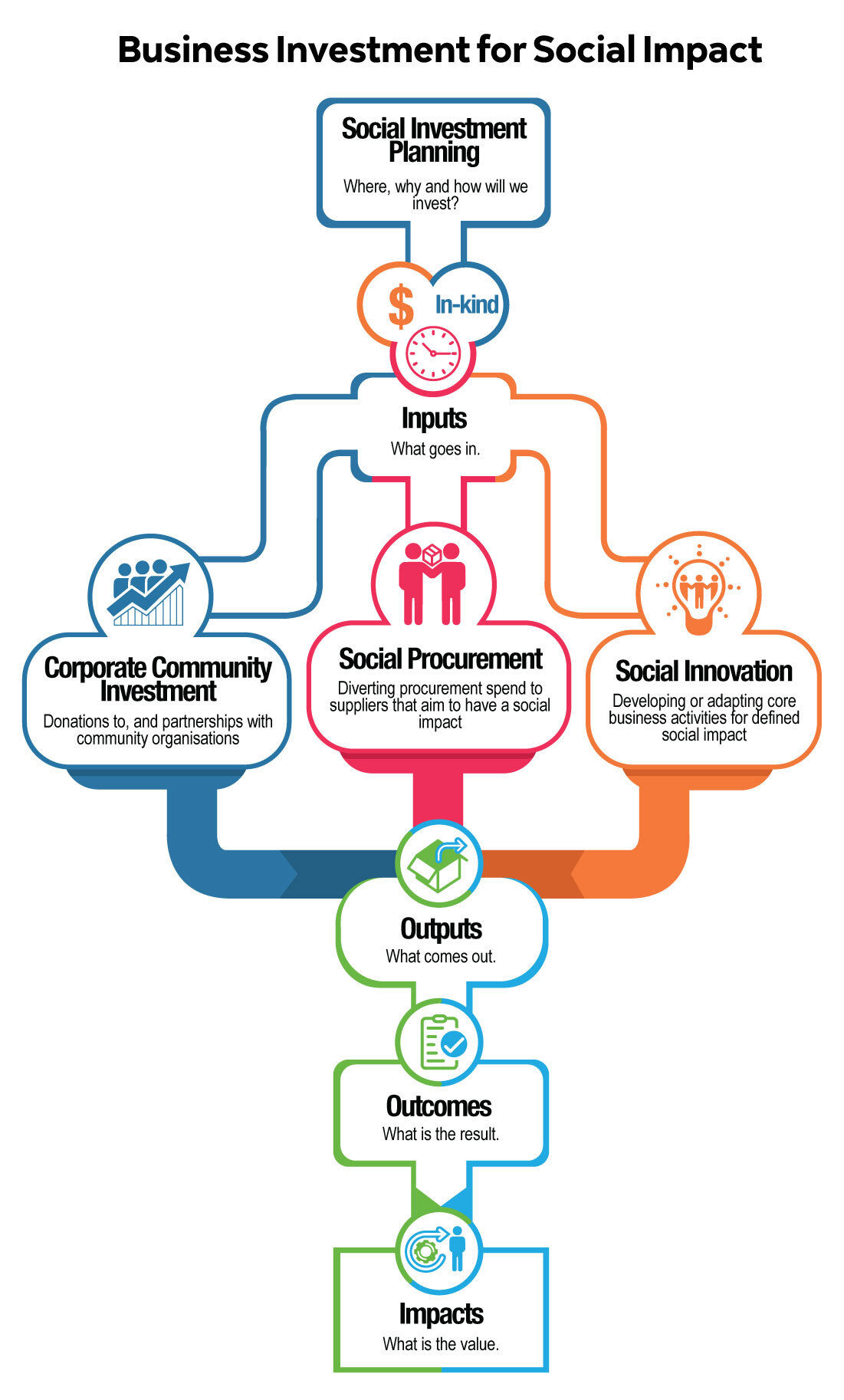

The process of Investing for Social Impact

The key elements towards mapping and understanding how much social change occurs because of business investment are shown in the diagram below. These elements are inputs, social impact strategy (e.g., corporate community investment, social innovation and social procurement), outputs, outcomes and impact.

There are differences between outputs, outcomes and impacts but these can be conceptualised as: what was delivered, the ‘outputs’, mid-term ‘outcomes’, and long-term ‘impact’. The Impact Management Project (IMP) goes further to describe ‘Impact’ (whether positive or negative and based on global consensus), as comprising five dimensions: what, who, how much, contribution and risk.

Inputs

Embarking on a social investment strategy to achieve long-term social goals starts with the commitment of inputs. Inputs may be directly financial (i.e., cash), comprise the provision of ‘in-kind’ materials, products or services, or include corporate volunteering.

Cash inputs may also be used to leverage contributions by other organisations because they increase the investments chances of success. In-kind services may extend to administrative, managerial or legal advice if you are working in a partnership with limited resources, such as a small charity.

Regardless of the arrangement, businesses need to define and understand the long-term goal to ensure the type and amount of input or contribution produces a net benefit and long-term impact. That is, defining and managing the data that is required to measure inputs and how these translate into measurable outputs, outcomes and impact.

Social Investment Strategies

What is the best strategy in which to invest your resources and how is it done? The following sections use case studies to illustrate how businesses may create value through social impact investment via the three routes to impact as defined in Corporate Citizenships’s B4SI framework.

1. Corporate Community Investment (CCI)

Corporate Community Investment (CCI) helps the communities in which you operate, while also achieving business return on your investment. Corporate Citizenship, through their B4SI framework, posits CCI as part of the broader responsible business practices of an organisation. In their annual report, Managing the S in ESG, Global Annual Review 2020, Corporate Citizenship reported on global member activities.

A snapshot of these activities using the Inputs, Outputs and Impact framework is given below:

Inputs: most contributions were driven by strategic investment and 68% of the total contribution was cash (an average of $15.7M per member), 10% of the total contribution was time

Outputs: businesses are touching the lives of millions of people, with 61 million beneficiaries reached globally across LBG members, internal stakeholder engagement resulted in 486,286 employees volunteering in paid-time globally and 96,984 employees volunteering in their own time

Impact: 50% of businesses are undertaking impact measurement and engaging beneficiaries, to report on experiences of behaviour or attitude change (9%), skill development (24%) or direct impact on their quality of life (60%). Impact on organisations were new services or improvement of existing services (38%), increased reach and time spent with clients (61%) and improved management systems (13%). Impact on employee volunteers were improved job-related skills (54%), improved life skills (55%) and change in their behaviour and outlook (64%).

How are companies doing it?

Both the Corporate Citizenship (Global Annual Review 2020) and Strive Philanthropy (Giving Large 2020) reports highlight corporate contributions and investment in philanthropic efforts.

Here we take another look at Vicinity Centres, which we highlighted in our 2019 article. At that point, Vicinity Centres had established a community investment program to address youth disengagement and unemployment. Their three-year partnership with Beacon Foundation commenced in 2017 and was completed in 2020. The Social Return on Investment (SROI) study found that for every $1 Vicinity has invested in Beacon’s programs since 2017, there has been a positive ongoing economic benefit to the community of more than $22 each year.

In FY2020, Vicinity Centres invested $5.6M (including $1.5 M in cash) in local communities, compared to $3.1M in FY19, and 78% of their centres developed community investment plans to address catchment-specific root causes of youth-related issues. Vicinity Centre’s community investment activities are benchmarked using the LBG (B4SI) framework. Key impacts measured were:

positive change in behaviour/attitude (123)

developed new skills or increased personal effectiveness (131)

improved quality of life/wellbeing (91).

There was an increase in improved quality of life/wellbeing compared to the 2018 report (23) possibly reflecting the decreases (by about half) in the first two measures.

2. Social Innovation

Social innovation is one of the routes businesses can use to diversify the way their contributions impact society while delivering good business returns. B4SI describes this route as developing or adapting core business activities for defined social impact.

In 2019, we reported on the activities of Patagonia, which was listed No. 6 on Fast Company’s 2018 edition of the World’s Most Innovative Companies ‘for growing its business every time it amplifies its social mission’. In 2020, Patagonia remains in the news for environmental initiatives such as its food-focused offshoot – Patagonia Provisions, one of its five future products in 2018 – to address the need for positive change in the food industry.

We also reported on technological innovations for supporting customers accessing renewable energy (Smart Energy, NSW). Innovation in energy provision continues to expand with the growth of social enterprises such as Enova Community Energy who have created a new business model “dedicated to helping communities become energy independent using their own renewable energy supplies”. In addition, 50% of Enova’s profits (after tax and reinvestment) go back into community renewable energy projects, education and energy efficiency services, recognising that energy education is vital.

For more inspiration in the social innovation space, Social Change Central has listed 39 Australian social entrepreneurs to watch in 2021.

3. Social Procurement

B4SI defines this strategy as diverting procurement spend to suppliers that aim to have a social impact. In 2019, we considered case studies from Australia Post and Vicinity Centres.

Australia Post remain committed to reaching a $60 million spend target from 2019 to 2022 by procurement through social enterprises and indigenous businesses and are now a member of SEDEX, a global organisation that supports almost 60,000 brands to maintain decent working conditions within their supply chains. Australia Post’s sustainable employment (including procurement) initiatives are aligned with the UN Sustainable Development Goals (SDGs) – SDG5 Gender Equality, SDG8 Decent Work and Economic Growth, SDG9 Industry, Innovation and Infrastructure and SDG10 Reduced Inequalities.

Vicinity Centres have spent approximately $4.0M with social enterprises from FY18 to FY20 and report this spend has provided over 38,000 hours of work for disadvantaged people in their communities. In addition, to support their Reconciliation Action Plan (RAP), Vicinity Centres have expanded their indigenous procurement program with a cumulative spend of approximately $1.0M since FY18. An example of the latter is their relationship with Wilco Electricity, which is a Supply Nation certified Indigenous-owned business. The impact here includes three 4-year in-house electrical apprenticeships resulting from working with Vicinity.

From Inputs to Impact

The rebranding of LBG to B4SI champions the business opportunities of diversifying social impact strategies to include social innovation and social procurement, as well as community investment, and presents a global standard for measuring and managing a company’s positive social impact.

This brief review points to some of key performance indicators in use. These include:

Measures of inputs: e.g., cash investment ($), volunteering during paid and unpaid time (number of volunteers) and contribution by type (e.g., % cash, % in-kind)

Measures of outputs: e.g., spend targets on social procurement ($), outreach (no. beneficiaries in a program)

Measures of outcomes: e.g., social return on investment ($ return/$ invested), profit re-invested in the community (%)

Measures of impact: e.g., positive change in behaviour/attitude, developed new skills, improved quality of life (measured as numbers or % of beneficiaries).

Measures of outputs and outcomes may be difficult to distinguish, although specifying outcomes helps to set medium-terms goals that may be useful for managing progress to impact, by identifying programs that may not be contributing to the final goal, for example. There are many indicators above that are measured in dollar terms, which is a useful framework for businesses looking to provide both positive social impact and good returns.

The challenge of reporting on impact remains but the refreshed LBG/B4SI framework provides resources for members. In addition, knowledge sharing via the web is increasing, and there are other partnerships among global standard setters (for ESG disclosure and alignment with financial reporting) in the making. Nonetheless, a robust data collection, analysis and reporting platform, that is aligned to the organisation’s impact strategy, is key to generating value for business and society.

To learn more about the B4SI framework and membership Contact the Corporate Citizenship team.

Click here to read more about iSystain’s Social Investment reporting solution or contact us to organise a demo.